Can You Rollover A 401k To An Ira

If you plan to roll your 401 k into a roth ira you will need to open a brokerage account.

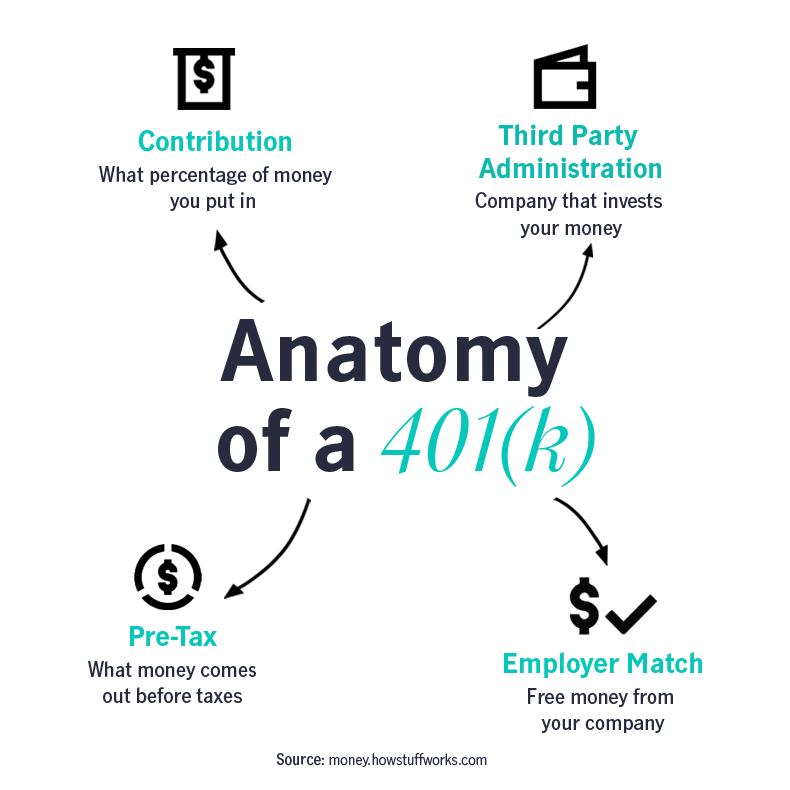

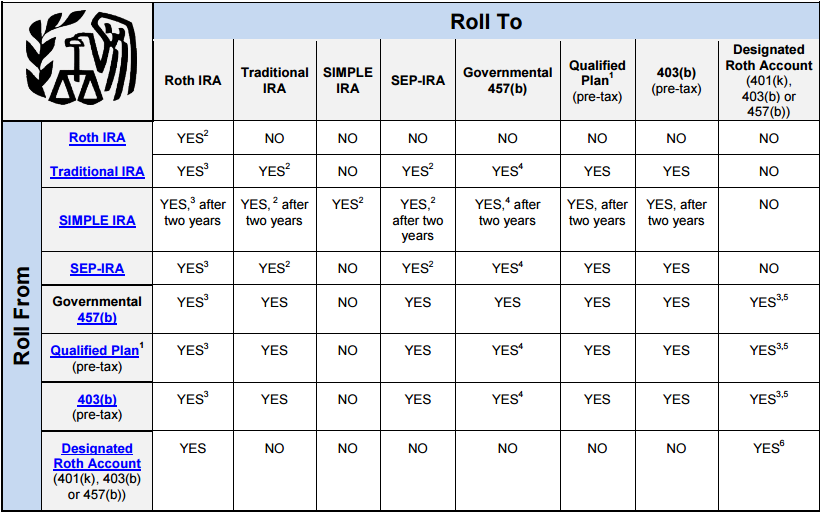

Can you rollover a 401k to an ira. Same goes for a roth 401 k to roth ira rollover. Roll to roth ira traditional ira simple ira sep ira governmental 457 b qualified plan1 pre tax 403 b pre tax designated roth account 401 k. In 2020 employees can contribute up to 19 500 to their 401 k plan. In the world of retirement account rollovers there s one type that doesn t get much love.

In 2018 you can contribute up to 18 500 annually to a 401 k and an additional 5 500 to an ira those figures rise to 24 500 and 6 500 if you re aged over 50. Although most people think of an ira rollover as moving funds from a 401 k to an ira there is also a reverse rollover where you move ira money back into a 401 k plan. Plus moving your money to an ira could help you. 3 brokerage options to rollover your 401k into a roth ira.

You can t roll a roth 401 k into a traditional ira. You can rollover from a traditional 401 k into a traditional ira tax free. After you ve done your rollover you can contribute to both your new company s 401 k and. Anyone age 50 or over is eligible for an.

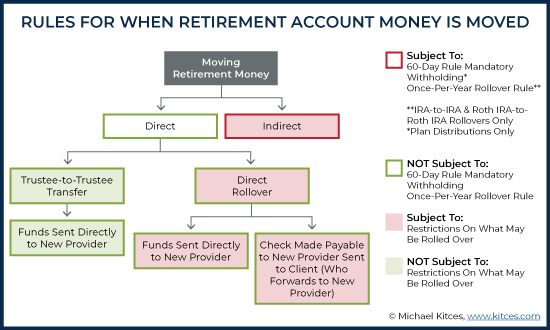

The ira to 401 k maneuver which allows you to roll pretax traditional ira assets into a 401 k. Td ameritrade for example offers bonuses ranging from 100 to 2 500 when you roll over your 401 k to one of its iras depending on the amount. Taxes will be withheld from a distribution from a retirement plan see below so you ll have to use other funds to roll over the full amount of the distribution. 60 day rollover if a distribution from an ira or a retirement plan is paid directly to you you can deposit all or a portion of it in an ira or a retirement plan within 60 days.

Beyond the type of ira you want to open you ll need choose a financial institution to invest with. If you have small ira accounts in many places and your employer plan offers good fund choices with low fees using this reverse rollover option can be a way to consolidate everything in one place.