Cash Advance Business Loans

Rapidadvance is now rapid finance.

Cash advance business loans. A pdq or merchant cash advance is a popular flexible finance alternative to a bank loan. Perhaps the biggest disadvantage is that this product is often used to solve the wrong problem. Loans from 500 500 000 only repay as you earn. What is a merchant cash advance.

They can both be used to meet business needs but have some fundamental differences which are crucial for business owners or entrepreneurs to understand. You will be redirected to our new site automatically. A loan is an amount of money that you ll be lent to do something. If you ve been in business at least 1 year and your monthly credit card transactions are over 3000 then you re already pre qualified.

In this post. Business loans merchant cash advance are two popular types of business financing. The term is now commonly used to describe a variety of small business financing options characterized by short payment terms generally under 24 months and small regular payments typically paid each business day. A merchant cash advance mca isn t technically a loan but rather a cash advance based upon the credit card sales of a business.

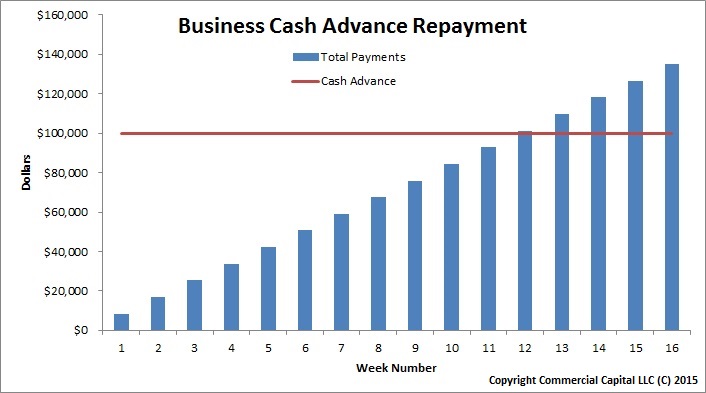

A merchant cash advance mca was originally structured as a lump sum payment to a business in exchange for an agreed upon percentage of future credit card and or debit card sales. Like any financial product business cash advance loans have advantages and disadvantages. What is a merchant cash advance. A merchant cash advance mca is an alternative to the lengthy approval process and strict credit requirements required for a traditional term loan.

Merchant cash advances and business loans are both working capital loans. A merchant cash advance mca is sometimes referred to as credit card factoring or a credit card processing loan you receive a lump sum that gets paid back via a fixed percentage of future debit and credit card sales holdback rate payments are automatically deducted each day and the size of your payments fluctuates with your debit and credit card. For example companies that have ongoing cash flow problems often due to slow paying clients won t usually get long term benefits from a short term solution because of how the solution is structured. Cash advances of the sort provided by nucleus represent an alternative to the traditional sort of loan.

The national funding merchant cash advance is an ideal solution for businesses that need cash quickly or want to smooth out the peaks and valleys of their cash flow. But what exactly are the differences between the a cash advance and a standard business loan and what reason is there to prefer one over the other.