50 000 Renters Insurance Policy

Top companies who provide 50 000 life insurance policies.

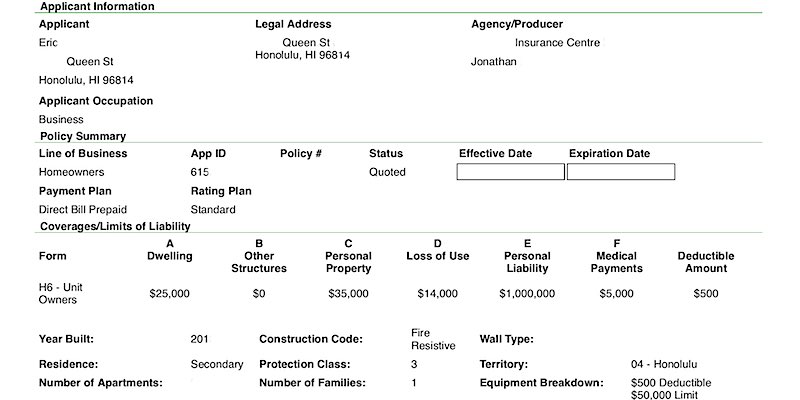

50 000 renters insurance policy. Most renters buying apartment insurance can expect to pay 20 or less per month for renters insurance. A policy like this would cost under 100 per year at many carriers according to cathy baum of allstate insurance in poway calif. That was just under the national average of 15 per month. About 50 000 people around the world work for liberty.

Renters insurance policies cover your personal property. For example if your apartment has a fire and the total loss is 50 000 but your policy s limit is 30 000 you will only be reimbursed 30 000. According to the insurance information institute oregon renters insurance cost an average of 163 for the year or 13 60 per month in 2017. Renters insurance costs 180 per year on average which is just 15 a month.

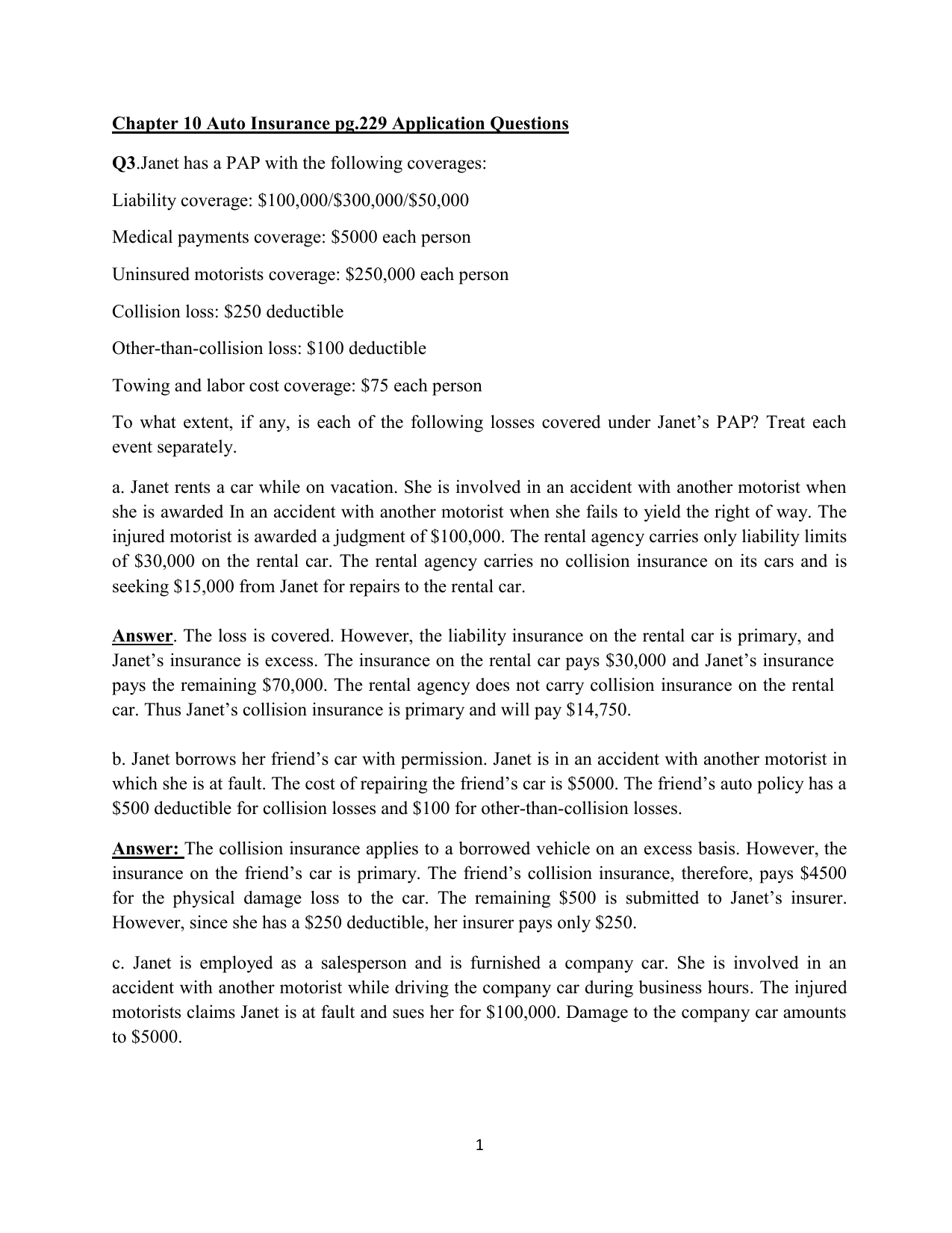

In this situation your insurer might recommend that you get more than the typical 20 000 or 30 000 policy making renters insurance a bit more expensive. Factors to consider before buying renters insurance. Average policy an average policy for someone who has accumulated more property might be a policy with a maximum coverage amount of 25 000 for personal property a 500 deductible and liability coverage of 100 000. That means you get the benefit of a defense paid for by the insurance company until the entire matter is settled or until they ve paid out 500 000.

Best companies for a 50 000 10 year term policy. The more coverage. Liability coverage that comes with a renters insurance policy will pay for legal fees and medical bills arising from an injury to a guest. We ve compiled an overview of the best companies to partner with for 50 000 of life insurance coverage broken down by types of policies.

Your personal property coverage will protect your belongings if they get damaged. Even if you re on a tight budget it s easy to fit the cost of renters insurance into your lifestyle. Another benefit of renters insurance is that it s cheap so there s no reason to not get a policy.