Choicepoint Credit Report

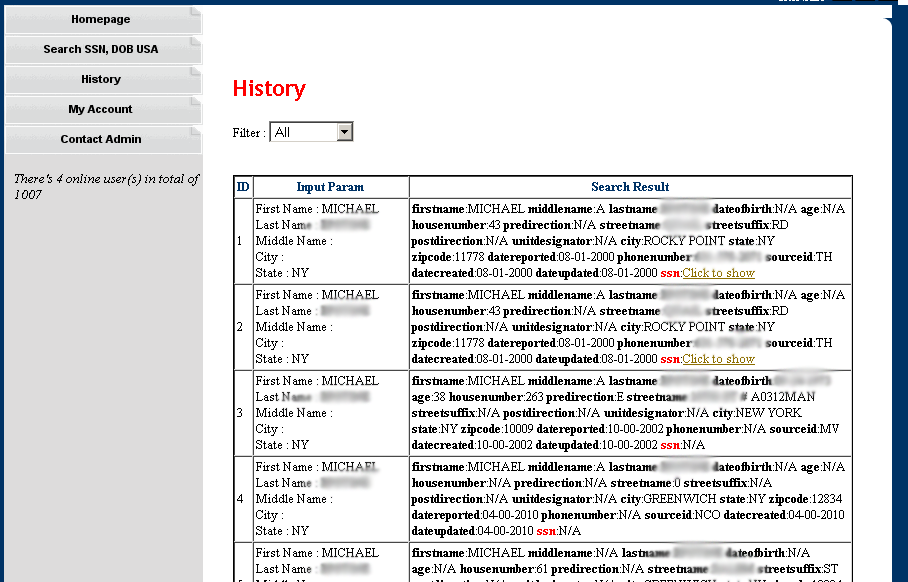

Choicepoint is a data aggregator firm that combines information from a variety of public and private databases and sells it to private sector firms and government agencies.

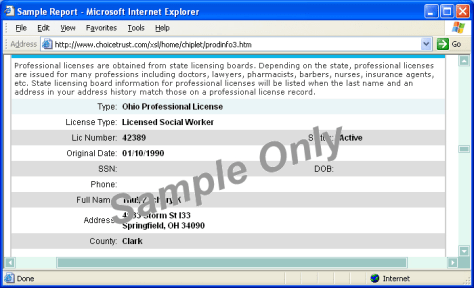

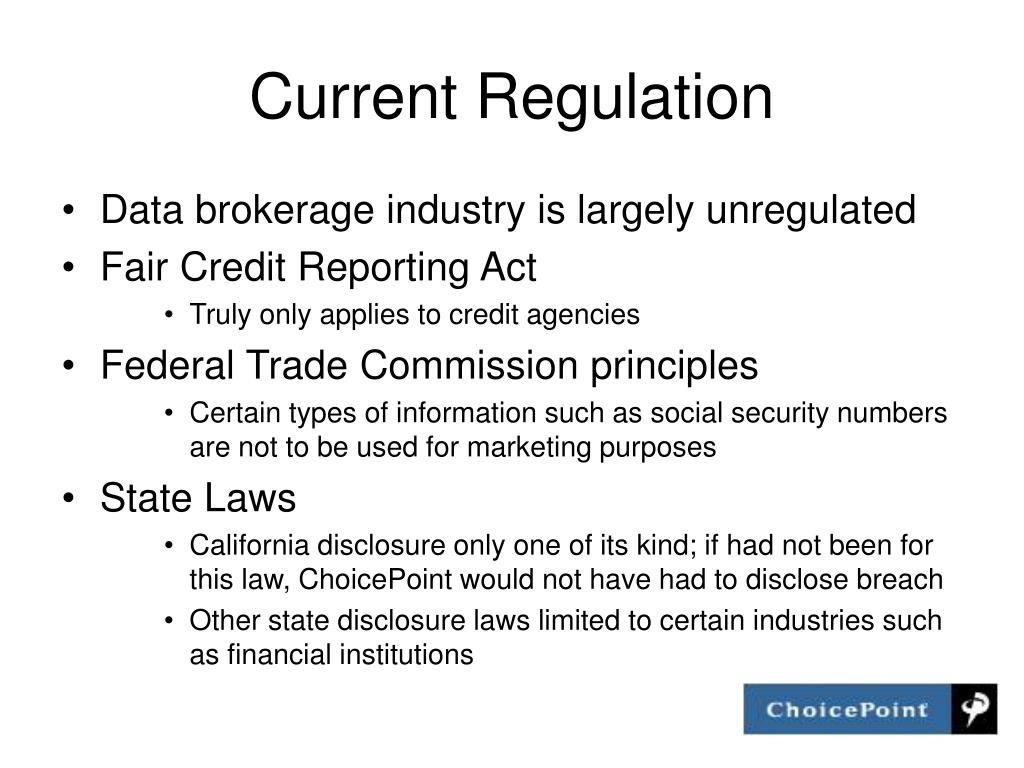

Choicepoint credit report. The publicly traded billion dollar company compiled and maintained credit information on more than 350 million credit cardholders around the globe by the late 1990s. The information turned over to the thieves included names addresses social security numbers and credit reports. Lexisnexis risk solutions uses big data proprietary linking and targeted solutions to provide insights that help make organizations more secure and efficient. The fact act entitles you to obtain one free copy of your applicable consumer report from certain consumer reporting agencies during a 12 month period.

In particular it sold significant amounts of personal information on 145 000 consumers to a group of identity thieves in california resulting in at least 700 known cases of fraud and identity theft. It is your responsibility to monitor your information and to dispute any mistakes or errors you spot. The report includes items such as real estate transaction and ownership data lien judgment and bankruptcy records professional license information and historical addresses. Request your consumer disclosure report electronically.

Errors can be very costly so it is important to make sure your credit reports are clean. If you received an adverse action letter. No one else will do this for you. Just remember all of the following databases are considered credit reporting databases under the fair credit reporting act fcra and as such are required to give you a copy of your information so you can check for errors.

The choicepoint story begins with credit report giant equifax inc based in atlanta georgia. You have the right to view your credit report annually for free. Citizen including social security numbers and credit reports. A choicepoint report is a type of credit report that is used by insurance companies landlords and employers to make decisions about the character and creditworthiness of applicants.

Request a fact act disclosure report. Pursuant to the fair credit reporting act. Our business profile reports provide you with an in depth view of a company s financial position including actual trade payment experiences public records predictive future payment habits and financial stability.